-40%

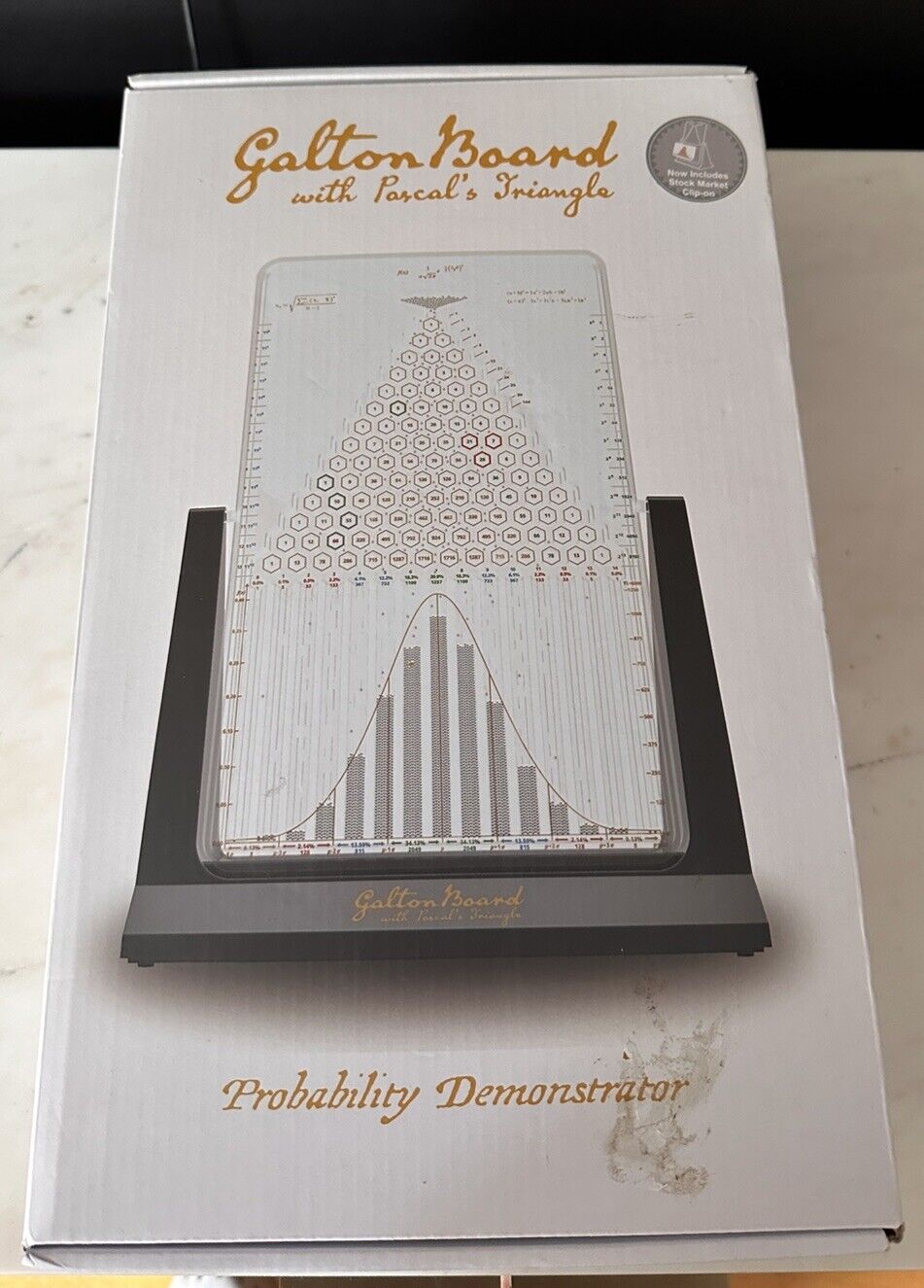

Galton Board with Pascal's Triangle- Probability Demonstrator (12"x 8.5") Stock

$ 92.4

- Description

- Size Guide

Description

Galton Board with Pascal's Triangle- Probability Demonstrator (12"x 8.5") Stock.Comes with stock market add on. Item is new and sealed but box has been opened and has some wear.

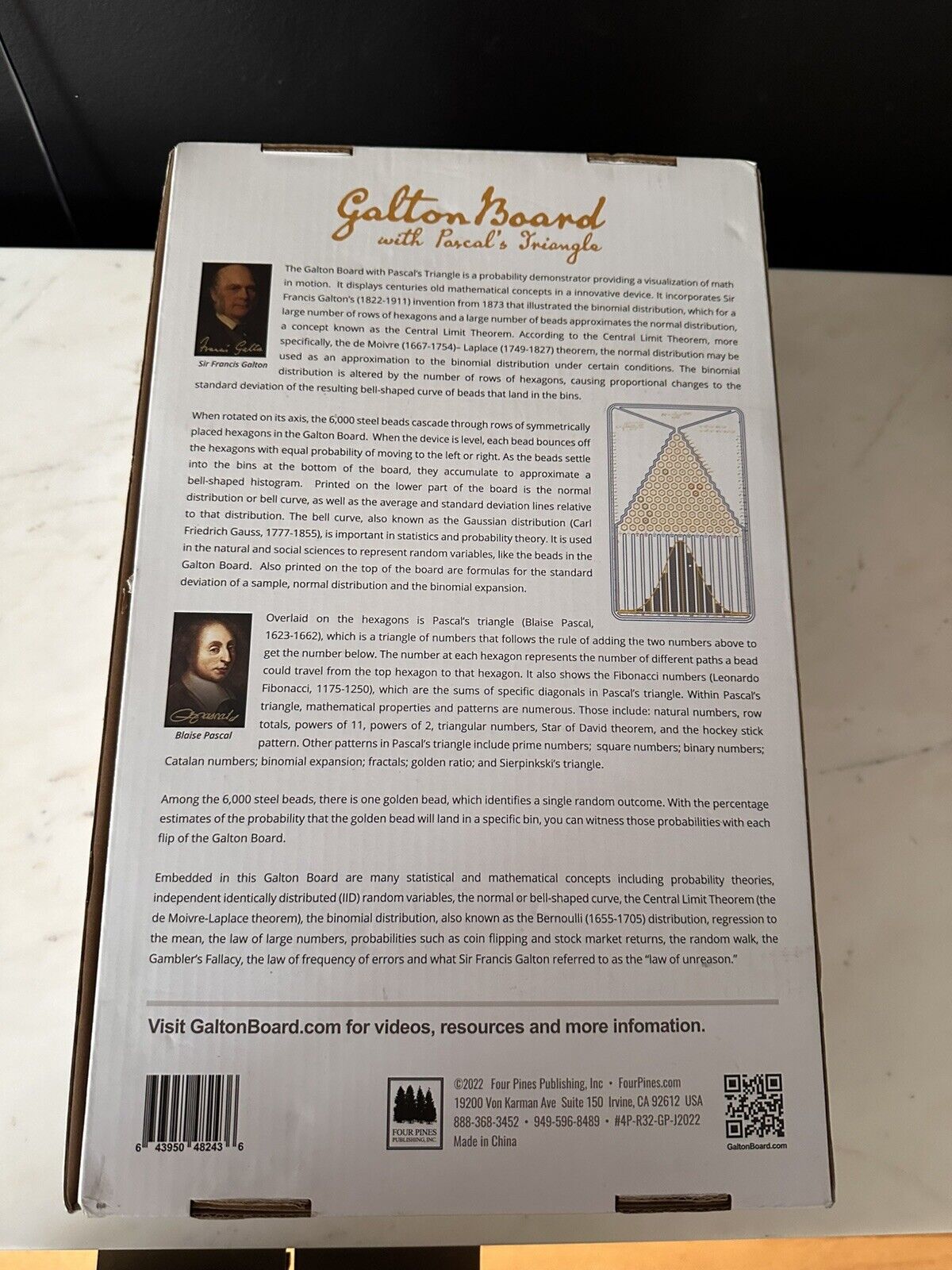

The Galton Board with Pascal’s Triangle is a 12” by 9” (310mm by 218mm) probability demonstrator providing a visualization of math in motion and the powers of the probabilities and statistics. With the addition of the Stock Market Clip-ons, the board illustrates the randomness and the probabilities of various market returns.

The Galton Board displays centuries old mathematical concepts in an innovative, dynamic desktop device. It incorporates Sir Francis Galton’s (1822-1911) invention from 1873 that illustrated the binomial distribution, which for a large number of rows of hexagons and a large number of beads approximates the normal distribution, a concept known as the Central Limit Theorem. He was fascinated with the order of the bell curve that emerges from the apparent chaos of beads bouncing off of pegs in his board. According to the Central Limit Theorem, more specifically, the de Moivre (1667-1754) – Laplace (1749-1827) theorem, the normal distribution may be used as an approximation to the binomial distribution under certain conditions.

When rotated on its axis, the 6,000 steel beads and one large golden bead cascade through 14 rows of symmetrically placed hexagons in the Galton Board. When the device is level, beads bounce off of the 105 hexagons with equal probability of moving to the left or right. As the beads settle into one of the 15 bins at the bottom of the board, they accumulate to create a bell-shaped histogram.

Printed on the lower part of the board is the normal distribution or bell curve, as well as the average and standard deviation lines relative to that distribution. The bell curve, also known as the Gaussian distribution (Carl Friedrich Gauss, 1777-1855), is important in statistics and probability theory. It is used in the natural and social sciences to represent random variables, like the beads in the Galton Board. You can also see the Y-axis and X-axis descriptions, and numbered bins with expected percentages and numbers of beads.

Printed on the top of the board are formulas for the normal distribution, standard deviation and binomial expansions.

Overlaid on the hexagons is Pascal’s triangle (Blaise Pascal, 1623-1662), which is a triangle of numbers that follows the rule of adding the two numbers above to get the number below. The number at each hexagon represents the number of different paths a bead could travel from the top hexagon to that hexagon. It also shows the Fibonacci numbers (Leonardo Fibonacci, 1175-1250), which are the sums of specific diagonals in Pascal’s triangle. Within Pascal’s triangle, mathematical properties and patterns are numerous. Those include: natural numbers, row totals, powers of 11, powers of 2, figurate numbers, Star of David theorem, and the hockey stick pattern. Other patterns in Pascal’s triangle not identified on this board include prime numbers; square numbers; binary numbers; Catalan numbers; binomial expansion; fractals; golden ratio; and the Sierpinski triangle.

Among the 6,000 steel beads, there is one golden bead, which demonstrates a single random outcome. Shown on top of each bin is the percentage estimates of the probability from Pascal’s triangle that a bead will land in that bin. By following the golden bead, you can clearly observe those probabilities with each flip of the Galton Board. When a Stock Market Clip-on is in place, the golden bead can represent the likely range and probabilities of next month’s stock market return. The Galton Board’s probabilities as to which bin the golden bead will land in is a substitute for the prediction of stock market forecasters.

Embedded in this Galton Board are many statistical and mathematical concepts including probability theories, independent identically distributed (iid) random variables, the normal or bell-shaped curve, the Central Limit Theorem (the de Moivre-Laplace theorem), the binomial distribution (also known as the Bernoulli (1655-1705) distribution), regression to the mean, the law of large numbers, probabilities such as coin flipping and stock market returns, the random walk, the Gambler’s Fallacy, the law of frequency of errors and what Sir Francis Galton referred to as the “law of unreason.”